The Great Migration: Why Global Capital is Flowing East

Something unprecedented is happening in the world of high-stakes horology. From the penthouses of Manhattan to the skyscrapers of Dubai, the world’s most sophisticated collectors are staging a massive exit from Western boutiques. The destination? Tokyo.

Smart money has realized that the traditional retail model is broken. While boutiques in the West offer empty promises and “patience taxes,” Japan offers immediate access to the world’s most pristine Vacheron Constantin and Patek Philippe inventory. This isn’t just a trend; it’s a global migration of wealth into the world’s safest watch market.

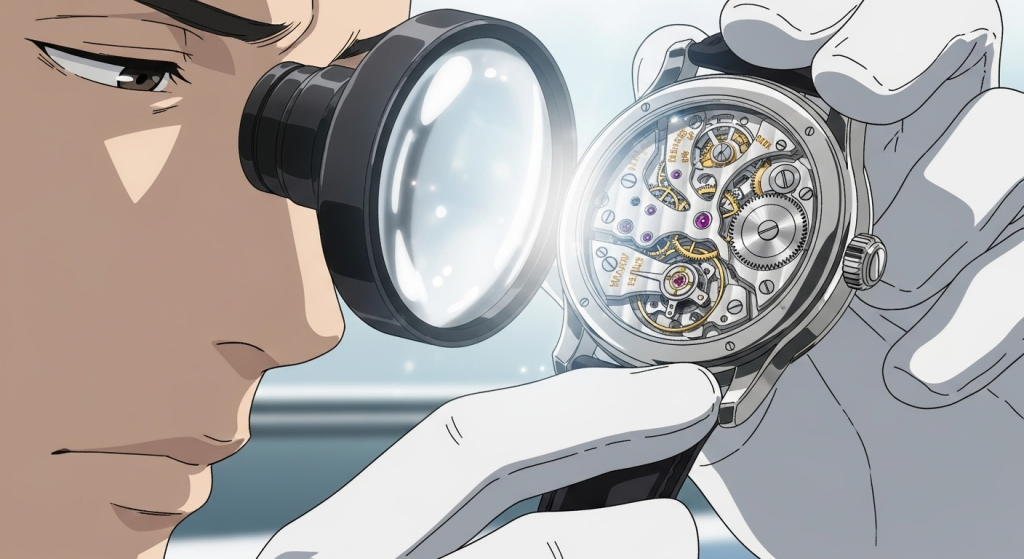

The “Japanese Mint” Obsession: More Than Just a Grade

Why are thousands of collectors suddenly obsessed with Japanese inventory? Because in Japan, “Mint Condition” isn’t a marketing term—it’s a cultural obsession. In the West, a “pre-owned” A. Lange & Söhne often carries the scars of its previous life. In Japan, it is treated like a religious artifact.

Global buyers are flooding into Tokyo because they’ve discovered the “Japan Secret”: a watch used for ten years in Tokyo often arrives in better condition than a new watch sitting in a London display case. The world is finally catching on to the fact that Japan is the only place where perfection is standard.

The Death of the Global Scam: Why Integrity Lives in Tokyo

As the global market becomes a “Wild West” of high-quality fakes and “Franken-watches,” Japan has become the world’s last fortress of integrity. The surge in global demand for Japanese Jaeger-LeCoultre and Rolex isn’t just about the watches; it’s about the peace of mind.

Japan’s strict laws and the cultural shame associated with counterfeit goods have created a “Zero-Trust” environment for fakes. When a collector in California buys from LUXURY JAPAN, they aren’t just buying a Reverso; they are buying an ironclad guarantee that the world’s most disciplined experts have vetted every single screw.

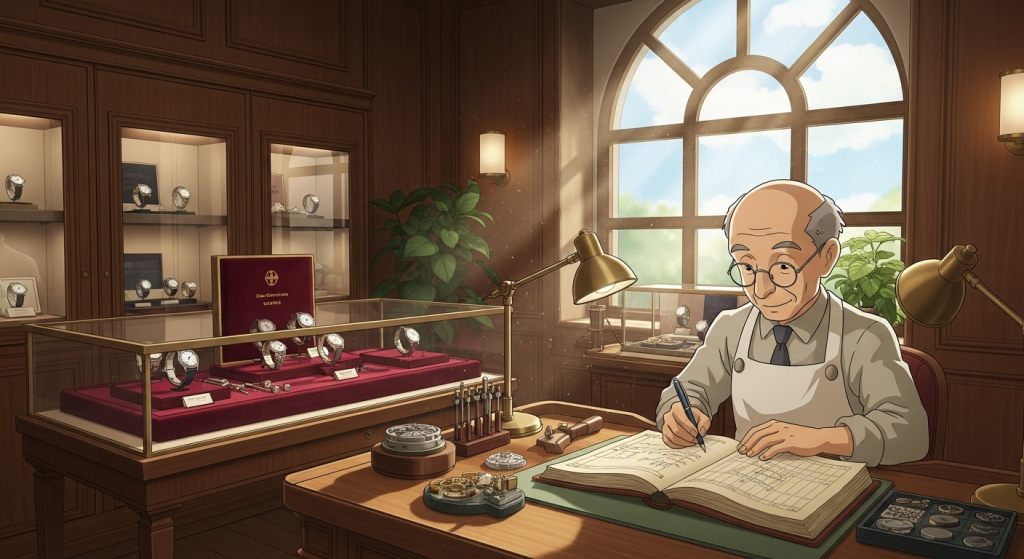

The Safe Haven: Treating Mechanical Art Like Gold

In times of global economic uncertainty, the wealthy look for “Safe Havens.” While stocks and crypto fluctuate, high-complication Breguet and Patek Philippe pieces held in Japanese vaults have become the new gold standard.

Collectors are draining Japan’s supply because they recognize that a Japanese-maintained timepiece is a “Liquid Asset.” Because these watches are kept in such flawless condition, their resale value remains globally dominant. Smart investors are moving their cash into Japanese timepieces because they know the quality is guaranteed to hold for the next generation.

The Final Grab: Securing the “Japan Limited” Ghost

There is a ticking clock on the Japanese market. As more global collectors discover the “Japan Limited” Hublot and Seiko editions, the supply is shrinking fast. These pieces, once the best-kept secret of the Tokyo elite, are now being hunted by collectors from Paris to Seoul.

We are currently seeing a “Final Grab” for these exclusive models. The world has realized that if you want the ultimate flex—a watch no one else has in a condition no one else can match—you have to get it from Japan before the vaults run dry.

The vaults are opening. Will you be the one to secure the prize? Explore the collection: